KEPCO continues losing streak amidst poor power outlook

Losses only narrowed thanks to high nuclear utilisation rates.

South Korean utility KEPCO’s net losses for the second quarter of 2019 narrowed QoQ and YoY due to the higher-than-expected nuclear utilisation rate and lower electricity purchase costs. Nuclear utilisation rate was at 83% and 76% for Q2 and Q1 respectively, significantly higher than 66% in 2018.

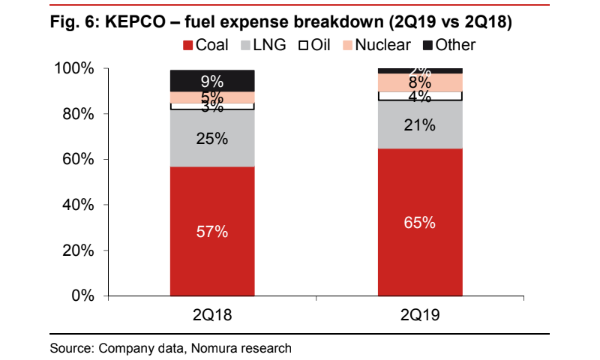

Whilst management did not provide guidance on the nuclear utilisation for 3Q2019/4Q2019F, it continues to expect mid-70% utilisation rate for coal, Nomura said in a note. Coal utilisation in 2Q2019 stood at 58%, down from 72% in 1Q2019.

However, concerns remain around the uncertainty regarding the nuclear and coal utilization outlooks, weaker KRW/USD, and the electricity tariff, which is unlikely to rise in the next 6-12 months. “Key variables that determine KEPCO’s earnings – tariff, feedstock costs, forex, and nuclear/coal utilizations – seem uncertain and bleak, in our view. Hence we retain our forecasts for net losses 2019-2021F,” said Nomura analyst Cindy Park.

Downside risks include the tariff cut announcement, the decline in lowest-cost nuclear or coal utilisations, and the fuel cost increase led by coal, oil (indicator for LNG) and IPP purchase prices. However, Park noted that this could be reversed with an industrial tariff hike and the government’s intention to turn around KEPCO’s earnings and returns.

For Q2, KEPCO’s power generation mix comprised 40% nuclear, 41% coal, and 7% LNG. KEPCO’s nuclear representation rose on the back of higher nuclear utilisation whilst coal representation fell.

Advertise

Advertise